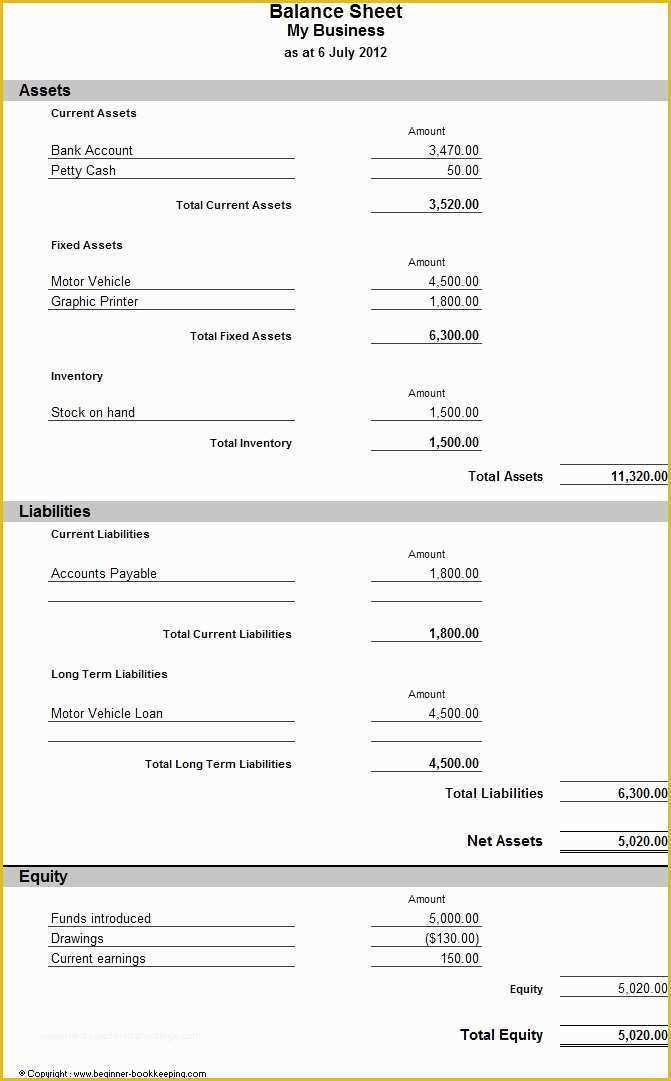

Many different financial ratios can be calculated from the information on a balance sheet. The assets are made up of fixed and intangible assets, bank, stock and debtors. Assets – Fixed Assets, Current Assets, intangible assets, stock, cash, money owed from customers (accounts receivable ledger) and prepayments.

The current ratio

But unless you use them in tandem with income statements and cash flow statements, you’re only getting part of the picture. Learn how they work together with our complete guide to financial statements. The financial statement only captures the financial position of a company on a specific day. Looking at a single balance sheet by itself may make it difficult to extract whether a company is performing well. For example, imagine a company reports $1,000,000 of cash on hand at the end of the month. Without context, a comparative point, knowledge of its previous cash balance, and an understanding of industry operating demands, knowing how much cash on hand a company has yields limited value.

Liabilities

Explore our finance and accounting courses to find out how you can develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential. If you’ve found that your balance sheet doesn’t balance, there’s likely a problem with some of the accounting data you’ve relied on. You may have omitted or duplicated assets, liabilities, or equity, or miscalculated your totals.

Get in Touch With a Financial Advisor

Thus, anyone reading a balance sheet should examine the footnotes in detail to make sure there aren’t any red flags. In this article, we’ll explain everything you need to know about a business’s balance sheet. Note that in our basic balance sheet template, the “Total Assets” and “Total Liabilities” line items include the values of the “Total Current Assets” and “Total Current Liabilities”, respectively. The ending retained earnings balance recognized on the balance sheet equals the beginning balance plus net income, net of any dividend issuances to shareholders. Conceptually, a company’s assets refer to the resources belonging to the company with positive economic value, which must have been funded somehow.

Calculate total net working capital (TNWC)

A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. In both cases, the external party wants to assess the financial health of a company, the creditworthiness of the business, and whether the company will be able to repay its short-term debts. The report provides helpful information when assessing a company’s financial stability. Financial ratios are used to calculate the business’s financial position, including liquidity and gearing ratios. Banks and suppliers use them to determine if they can offer a loan, overdraft or credit facility. A balance sheet is an important reference document for investors and stakeholders for assessing a company’s financial status.

A balance sheet is a financial statement that lists a company’s assets, liabilities, and equity. The purpose of a balance sheet is to provide a summary of the entity’s financial position at a specific point in time. As such, the balance sheet may also be referred to as the statement of financial position. As described at the start of this article, a balance sheet is prepared to disclose the financial position of the company at a particular point in time. For example, investors and creditors use it to evaluate the capital structure, liquidity, and solvency position of the business. On the basis of such evaluation, they anticipate the future performance of the company in terms of profitability and cash flows and make important economic decisions.

Lenders will want to verify that you are able to pay back your debts. Not only will you need to know this figure, but potential buyers will want to know—and have the proof to back it up. Updates to your application and enrollment status will be shown on your account page. We confirm enrollment eligibility within one week of your application for CORe and three weeks for CLIMB.

Understanding the investment, financing and operating cycles is essential for assessing a company’s financial health. They shed light on the way it finances its investments and manages its day-to-day operations, aspects that are fundamental to financial strategy. Another difference is that the accounting balance sheet gives more detail, whereas the operating balance sheet does not. For example, the balance sheet shows only ”tangible fixed assets”, without going into detail. These two balance sheets are distinct, but the operating balance sheet is based on data from the accounting balance sheet.

- If the WCR is positive, this means that the company has little or no trade payables, but does have stock and trade receivables.

- A potential investor or loan provider wants to see that the company is able to keep payments on time.

- In order to get a more accurate understanding of the company, business owners and investors should review other financial statements, such as the income statement and cash flow statement.

- While this is very useful for analyzing current and past financial data, it’s not necessarily useful for predicting future company performance.

This means that the assets of a company should equal its liabilities plus any shareholders’ equity that has been issued. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. The balance sheet is prepared by either a business owner, bookkeeper or accountant. If Companies House requires it, an accountant is the best person to prepare and submit the accounts, as they will know the generally accepted accounting principles. The current ratio is calculated by dividing the total current assets by the total current liabilities.

Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations. A company’s balance sheet is one of three financial statements 5 ways debt can make you money used to give a detailed picture of the health of a business. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. When paired with cash flow statements and income statements, balance sheets can help provide a complete picture of your organization’s finances for a specific period.

The three financial statements are the Balance Sheet, the Profit and Loss Statement, and the Cash Flow Statement. This is whatever will remain if you subtract the liabilities of the company from the assets. Exactly how the equity is made up will vary from company to company, depending on the business type and stage. Maintaining a simple balance sheet is a smart way to track your company as it expands. Ready to take it to the next level and start working with international clients and investors? Get a Wise multi-currency business account to accelerate your business growth.